Statistics Canada released a new edition of the Canadian Survey on Business Conditions for the first quarter of 2021. Government regulations were the top obstacle reported by arts, entertainment and recreation organizations, followed by demand-related concerns. An earlier industry survey, the National Arts and Culture Impact Survey, had found much similar obstacles

The Canadian Survey on Business Conditions (CSBC) asked respondents “Over the next three months, which of the following are expected to be obstacles for this business or organization?” The following table ranks obstacles for the arts, entertainment and recreation sector by order of importance. Percentages higher than the all-industries average are highlighted.

| Business or organization obstacles over the next three months | Arts, entertainment and recreation (%) | All industries (%) |

|---|---|---|

| Government regulations | 43.6 | 22.9 |

| Insufficient demand for goods or services offered | 32.5 | 29.2 |

| Fluctuations in consumer demand | 30.1 | 31.4 |

| Maintaining sufficient cash flow or managing debt | 29.4 | 24.2 |

| Travel restrictions | 25.7 | 19.3 |

| Recruiting and retaining skilled employees | 19.6 | 24.1 |

| Obstacles for the business or organization, none | 18.6 | 17.9 |

| Cost of insurance | 16.9 | 20.1 |

| Rising cost of inputs | 14.1 | 25.5 |

| Obstacles for the business or organization, other | 13.7 | 6.2 |

| Increasing competition | 12.2 | 19.1 |

| Obtaining financing | 11.5 | 10.3 |

| High speed internet | 10.0 | 7.2 |

| Supply chain challenges | 8.4 | 23.8 |

| Shortage of labour force | 8.0 | 19.5 |

| Shortage of space or equipment | 7.0 | 5.2 |

| Maintaining inventory levels | 4.4 | 13.3 |

| Intellectual property protection | 4.3 | 1.5 |

| Challenges related to exporting goods and services | 3.8 | 3.4 |

Observations about obstacles among arts, entertainment and recreation businesses

- First of all, it’s important to note that arts and heritage industries only represent a portion of the arts, entertainment and recreation sector. Other industries in this classification include spectator sports, amusement parks, casinos, and fitness centres, to name a few.

- Unsurprisingly, demand-related and travel obstacles rank high and are comparable or higher than the all-industries average.

- “Recruiting and retaining skilled employees” is lower than the all-industries average. This runs counter to insights from the Labour Force Survey and to anecdotal information heard in the sector. This obstacle may have not been fully experienced yet since most of the sector was still in full shutdown when the CSBC was fielded.

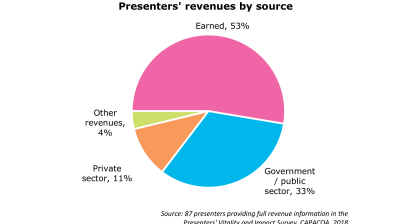

- “Maintaining sufficient cash flow or managing debt” will be a significant obstacle for some organizations. “Obtaining financing”, much less so. This could indicate that financing programs such as the Highly Affected Sectors Credit Availability Program aren’t seen as a viable solution to cash flow problems by arts, entertainment and recreation organizations. According to annual surveys of service industries, the margin of profit of performing arts and presenting organizations typically hovers between 0.1 and 1%. This leaves little financial room for paying back loans.

- “Intellectual property protection” ranked second last (4.5%), but it was almost three times higher than the all-industries average (1.5%). This is likely reflective of challenges experienced by arts organizations as the pandemic forced many to shift to online activities. Online dissemination of creative content triggers several different rights, which in turn engenders many questions and concerns about fair compensation in the online environment.

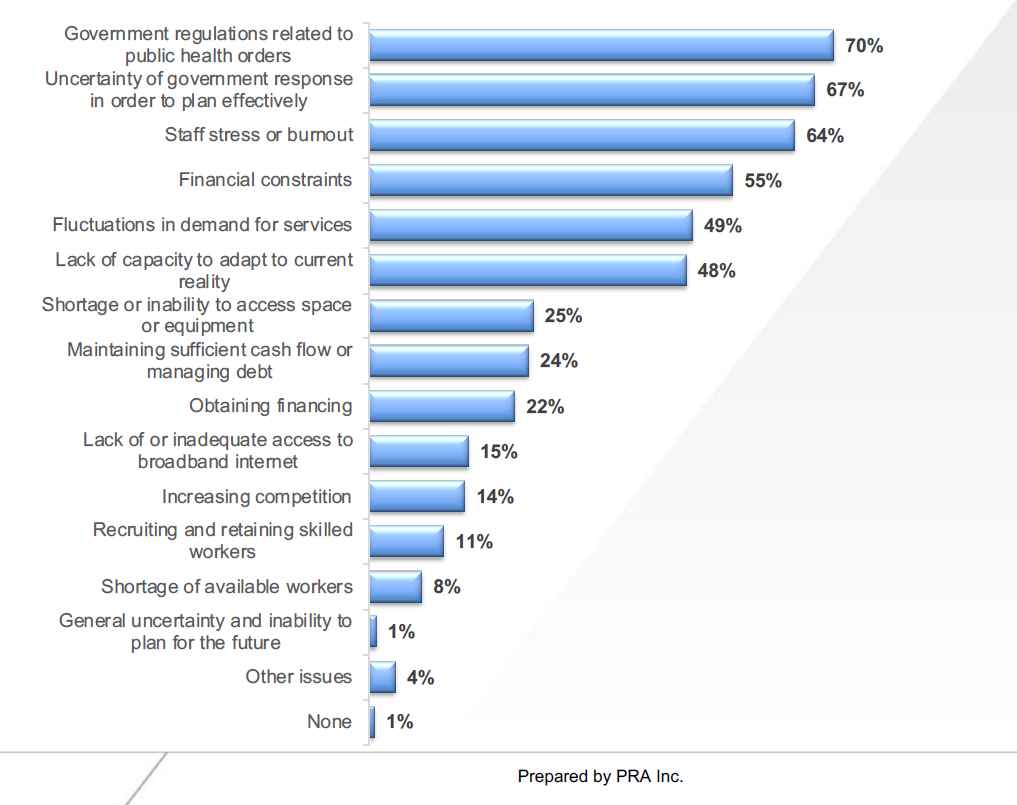

- “Obstacles for the business or organization, other” (13.7%) was two times higher than the all-industries average (6.2%). What are these other obstacles? According to the National Arts and Culture Impact Survey (see), other obstacles encountered by arts organizations last fall included:

The Canadian Survey on Business Conditions offers a lot more information on the expectations of businesses moving forward and on the ongoing impact of the pandemic on businesses in Canada. You can read more in The Daily, or in the summary published on our COVID Impact Statistics page.

Another point of view: the National Arts and Culture Impact Survey

The National Arts and Culture Impact Survey (NACIS), is industry-led survey conducted in the fall among arts and culture organization. Even though it asked about many of the same obstacles, the difference in the target population and the survey period yielded different ratings than the CSBC. Here are the obstacles reported on p. 10 in the organization report.

Obstacles experienced by one in two organizations included all top three obstacles found in the CSBC, plus these ones:

- Uncertainty of government response in order to plan effectively (67%)

- Staff stress or burnout (64%)

- Financial constraints (55%)

- Lack of capacity to adapt to current reality (48%)

The NACIS also includes relevant insights about attitudes towards the pivot to digital programming and about government support.