As the third wave of the pandemic once again puts the live performance sector to a stop, more and more cultural consumers have turned to online performances at least once according to recent consumer surveys. And for the vast majority, more than once. These surveys also offer meaningful insights on the perceived value of in-person and online events.

In-person and online: very distinct value propositions

Wave 4 of the Arts Response Tracking Study (ARTS), a rigorous survey of Canadian consumers, explored the value proposition of online and in-person. The open-ended responses collected in the survey shed a light on the unique, unreplicable features of the live performance:

- Social interaction/sense of community > 32%

- The entire experience/it’s more engaging > 29%

- The ambience/atmosphere > 11%

The findings of a one-time Survey of Quebec Audiences highlight similar benefits. “Sharing the experience with friends or with family” (65%) is what audience members have missed the most since the beginning of the pandemic. The “presence of artists and contributors” (62%) is close second. “Energy from the crowd and sense of community” (45%) also rank high.

Online events offer a distinct but nonetheless relevant value proposition for four in five consumers, according to the ARTS survey.

Unsurprisingly, the ability to still enjoy an event (22%) and the accessibility and convenience (20%) are what consumers value most about online events. The Survey of Quebec Audiences and the August wave of the Ontario Audience Outlook Monitor also found that the option of watching any time during the week following the live performance had strong appeal for consumers.

But that’s not all. Further responses from the ARTS survey suggest certain consumers are taking advantage of online events to broaden their horizons:

- Educational/learn new things > 7%

- More variety options > 5%

- The event can originate from anywhere in the world/experiencing different cultures > 5%

This coincides with findings from the Digital Audience Survey, an online survey coordinated by The Audience Agency in the UK in November. 59% agreed or strongly agreed that they had discovered new forms of arts and culture online. Another 57% reported engaging with arts and culture online to boost their mood.

Many consumers are getting into a habit of paying for online performances

Since last year, the propensity to pay (i.e., the proportion of consumers who are willing to pay) for online events appears to have held still and, in some cases, increased . Furthermore, we are seeing early indicators that it might last after the pandemic.

The Ontario Audience Outlook Monitor observed a large increase in actual purchasing behaviour. Between the October and the February waves, the proportion of Ontarians who reported watching and paying for online cultural programs in the past two weeks jumped from 19 to 30%. In the Entertainment Barometer, the proportion of Quebec consumers who watched and paid for online events since the beginning of the pandemic had reached 34%.

And it looks like there will be a niche market for paid online performance even after the pandemic. In Wave 4 of Culture Restart, the proportion of UK consumers who are interested and intend to continue to engage and pay for online events remains stable at 23 % of interested respondents (which is 16 % of the total sample). In the February wave of the Entertainment Barometer, one in two Quebec consumers are probably (38%) or certainly (13%) willing to pay for online cultural events in the future. In both surveys, actual purchasing behaviour and propensity to pay are high among millennials and respondents aged 75 +. In the Audience Outlook Monitor, 17% of Ontarians declare that online programs will continue to occupy a substantial place in their lives, even once facilities reopen.

The anchor price for online performances is also moving up. The average psychological price reported by Entertainment Barometer respondents increased from CAD$16 in April 2020 to roughly $25 in February 2021. Trends in Audience Behaviour found an average yield of USD $38 for digital tickets in February 2021, which was 60% of the yield of in-person tickets.

“Free” is a poor value proposition

People consume free content, because they are exposed to an abundance of it. But “free” is not necessarily something they value about an online event. Only 1.3% of ARTS respondents said free or low price was something they value. In comparison, 2.9% said they value the video/sound quality and 3.1% said they like supporting artists.

As JCA Arts Marketing pointed out in their report “make sure your patrons understand the value of digital performances, per person and per household.” The National Arts Centre and other co-presenters in the Digidance series took this advice to heart. Their pricing strategy invites buyers to choose between a “solo” ticket (a single link giving access to streaming for 1 person) or a “family” ticket (a single link giving access to streaming for 2 people or more on the same device).

Other useful findings

All Canadian surveys cited in this post also include information on readiness to return to in-person events. The ARTS report cross-tabulates responses by different regions of the country.

Upcoming events

Findings from some of these surveys will be explored during two online conferences in April.

Data Echo Culture: Gathering Around Data in the Cultural Sector, April 27-29

Canadian Arts Summit, April 27-30

Sources

Canadian sources:

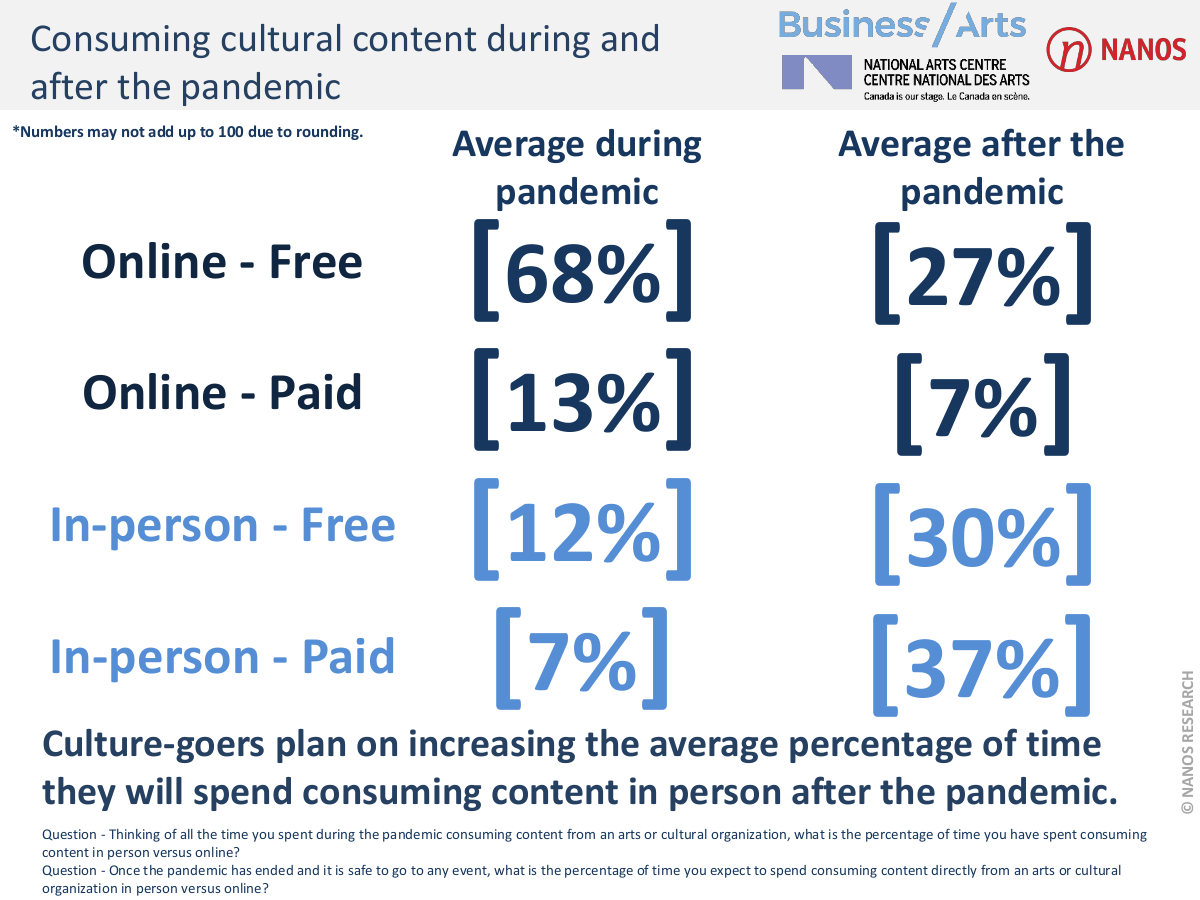

Nanos Research, Arts Response Tracking Study, Wave 4 (February 2021), commissioned by Business/Arts in partnership with the National Arts Centre, March 2021.

WolfBrown, COVID-19 Audience Outlook Monitor: Wave 4 (February 2021), commissioned by the Ontario Arts Council in partnership with the Toronto Alliance for the Performing Arts, March 2021.

Habo and Lepointdevente.com, Entertainment Barometer: Quebecers and entertainment in times of COVID-19, Edition 6 (February 2021), March 2021

Hervé Guay et Claudia-Barbara Sévigny-Trudel, Publics québécois des arts de lascène : portrait de groupe pendant et après l’épidémie de COVID-19 à Montréal et en région, commissioned by Université du Québec à Trois-Rivières, Laboratoire de recherche sur les publics de la culture, and Synapse C, March 2021.

US source:

JCA Arts Marketing, Trends in Audience Behaviour: Digital Performances in the Growth Stage, Round 2 (February 2021), March 2021

UK sources:

Baker-Richards, Culture Restart Audience Tracker: Wave 4 (January 2021), February 2021

The Audience Agency, Digital Audience Survey (November 2020), December 2020.

Written by: Frédéric Julien, Director of Research and Development, CAPACOA