Non-Resident Taxation

A major event such as Festival International de Jazz de Montréal presents each year a large number of foreign artists.

Every arts organization who makes a payment to a non-resident artist or company for services rendered in Canada must withhold and remit a 15% withholding tax (arts organizations established in Quebec are also subject to additional withholding requirements).

While a waiver process exists, it is administratively cumbersome and slow.

In addition, there are information return and tax return obligations that are little known, but that can cause serious problems to non-resident artists. Failure to submit an information return or an income tax return will result in penalties, which will add another degree of complexity to any additional Canadian engagement the non-resident may have.

In order to achieve greater efficiency and better risk management in the administration of non-resident taxation, arts organizations have come together to form a Performing Arts Tax Working Group. This webpage provides resources and the latest news from this working group.

New Simplified Taxation Process

After three years of advocacy, the Canada Revenue Agency introduced in June 2018 a simplified income tax process for non-resident artists (known as R105-S). This simplified process addresses a few of the recommendations issued by the Performing Arts Tax Working Group, but it is quite limited in scope and application.

At this point, we do not recommend to direct foreign artists to R105-S, unless they are touring as an individual (or unincorporated group) and they reside in the United States.

The Performing Arts Tax Working Group continues the dialogue with the Canada Revenue Agency and other federal stakeholders in order to seek further streamlining to non-resident taxation.

Resources

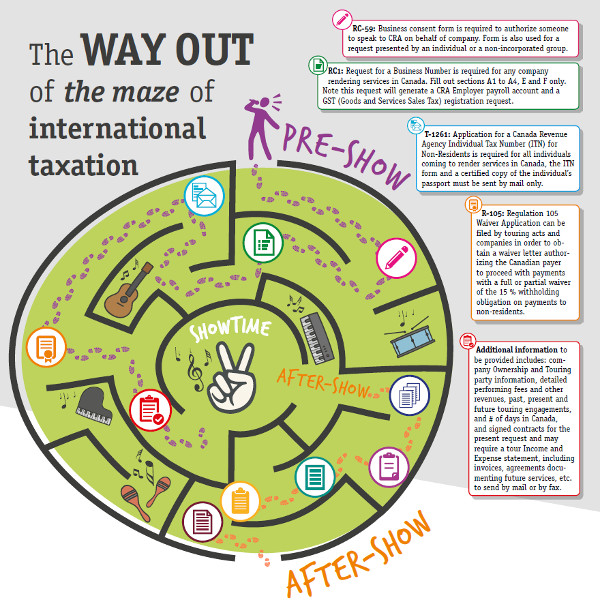

This infographic was developed for the Performing Arts Tax Working Group, with support from Regroupement des événements majeurs internationaux and Festivals and Major Events.

This infographic was developed for the Performing Arts Tax Working Group, with support from Regroupement des événements majeurs internationaux and Festivals and Major Events.

The Way Out of the Maze – main presentation

The Way Out of the Maze – overview of non-resident taxation

Recommendations by the Performing Arts Tax Working Group

News Updates

Streamlining of International Taxation: One Step Forward, Two Steps Forward – 10 July 2018

The Canada Revenue Agency Simplifies International Taxation in Response to Sector Recommendations – June 11, 2018

Mobility, Taxation, and Cultural Diplomacy Updates – March 6, 2018

Working Group Raises Taxation Issues with Finance Committee – July 27, 2017

International Taxation – There could be light at the end of the tunnel – May 16, 2017

Non-Resident Taxation: Costs of Compliance Outweigh Tax Revenues – April 7, 2017

Streamlining, Please – December 13, 2016

A Systems View of International Taxation – November 3, 2016

Dialogue on International Taxation Begins with CRA – March 7, 2016

New Government; Renewed Advocacy on International Taxation – December 9, 2015

Working Group Provides Comments on International Taxation – September 10, 2015

Expanded Requirement for Foreign Artists Touring in Canada – June 4, 2015

Leveraging Budget 2015 – May 14, 2015

Tax Working Group Shares Recommendations on R105 Withholding – March 16, 2015

Arts Organizations Collaborate on Tax Withholding Matters – December 11, 2014